In today’s interconnected world, financial markets are influenced by a multitude of factors that can impact global market movements. From economic indicators to geopolitical events, investors and traders closely monitor these factors to make informed decisions. In this blog post, we will explore some of the latest factors that are currently shaping financial markets around the world.

Economic Indicators

Economic indicators play a crucial role in determining the health of a country’s economy and can have a significant impact on financial markets. Key indicators such as gross domestic product (GDP), inflation rates, and employment data are closely watched by investors. Positive economic indicators can lead to increased investor confidence, resulting in higher stock market prices and a stronger currency. On the other hand, negative indicators can spark market volatility and uncertainty.

Central Bank Policies

Central banks, such as the Federal Reserve in the United States and the European Central Bank, have a tremendous influence on financial markets. Monetary policy decisions, such as interest rate changes and quantitative easing programs, can have a direct impact on borrowing costs, investment decisions, and currency values. Investors closely analyze central bank statements and press conferences for hints about future policy changes, as these can cause significant market movements.

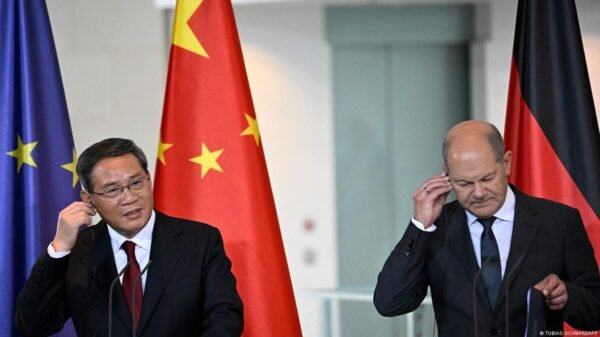

Geopolitical Events

Geopolitical events, such as elections, political unrest, and trade disputes, can have a profound impact on financial markets. Uncertainty surrounding these events can lead to increased market volatility and risk aversion among investors. For example, trade tensions between major economies can disrupt global supply chains and affect the profitability of multinational companies, leading to market fluctuations.

Technological Advancements

Technological advancements have revolutionized financial markets in recent years. The rise of algorithmic trading, high-frequency trading, and artificial intelligence has transformed the way financial assets are traded. These advancements have increased market efficiency and liquidity but have also introduced new risks. Cybersecurity threats and algorithmic trading glitches can cause sudden market disruptions, highlighting the need for robust risk management systems.

Social Media and News Sentiment

Social media platforms and news sentiment play an increasingly significant role in shaping financial markets. The speed at which information spreads through social media can lead to rapid market reactions. Positive or negative news sentiment can influence investor behavior and drive market movements. Traders and investors are now utilizing sentiment analysis tools to gauge market sentiment and make data-driven investment decisions.

Commodity Prices

Commodity prices, such as oil, gold, and agricultural products, have a direct impact on various sectors of the economy. Changes in commodity prices can affect the profitability of industries such as energy, mining, and agriculture. Additionally, commodity prices can influence inflation rates and currency values. Investors closely monitor commodity markets as they can provide valuable insights into the overall health of the global economy.

Global Health Crises

Global health crises, such as the COVID-19 pandemic, can have far-reaching implications for financial markets. These crises can disrupt global supply chains, impact consumer spending, and lead to widespread economic uncertainty. Governments and central banks often implement fiscal and monetary measures to mitigate the economic impact of such crises. Investors closely monitor developments related to global health crises as they can have significant implications for market movements.

Conclusion

As financial markets become increasingly interconnected, a wide range of factors can influence global market movements. Economic indicators, central bank policies, geopolitical events, technological advancements, social media sentiment, commodity prices, and global health crises all play a significant role in shaping financial markets. Investors and traders must stay informed about these factors to make informed decisions and navigate the ever-changing landscape of global financial markets.